This story was paid for by an advertiser. Better Report’s editorial staff was not involved in the creation of this content.

Most Americans enter retirement hoping their savings, investment decisions, and timing align to support their long-term goals — keyword: hoping. For the top 0.1% of wealth holders, though, the reality looks different. Their portfolios may be larger, but the distinction isn’t only about income. They’re in the top 0.1% of planners, tax managers, and decision makers.

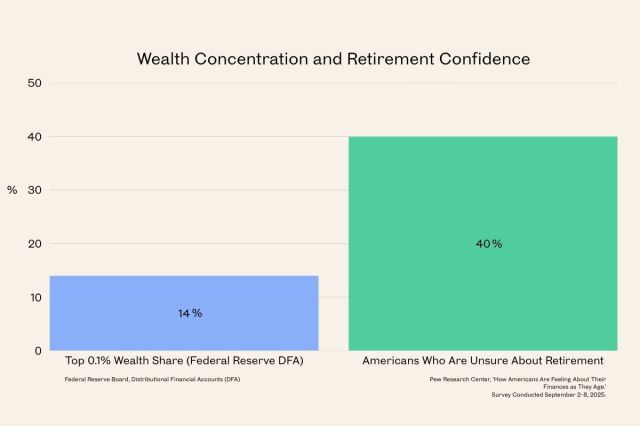

Federal Reserve data on household wealth distribution shows the share of the nation’s assets this small group holds. The numbers are startling, but they didn’t shift overnight. The data reflect habits formed long before retirement, including how these households manage taxes and coordinate different types of accounts.

How the Ultra-Affluent Approach Taxes

For the most affluent retirees, tax planning isn’t a once-a-year event. It’s something they add to their long-term strategy, especially when it comes to Required Minimum Distributions (RMDs), capital gains, and changes in taxable income. Instead of waiting until distributions are unavoidable, they may consider how taking money earlier or adjusting the timing of gains might help manage taxes over several years. A key part of the strategy is understanding how different types of investment income are taxed.

“Capital gains have a much lower tax rate than earned income, interest, or dividends. And therefore are advantageous in that regard, relative to interest and dividends, with a higher total return,” Ken Fisher, founder and executive chairman at Fisher Investments, said.

Rather than focusing on minimizing their tax implication in a single year, they adapt their strategy to keep their withdrawal plan steady and sustainable.

They Coordinate Their Withdrawals Across Multiple Accounts

Affluent retirees often coordinate their withdrawals across multiple account types. Traditional IRAs, Roth accounts, brokerage assets, and appreciated holdings each play a role. They’re used in combination to support post-work income needs and manage tax bills across different stages of retirement. A long-term mindset often guides those decisions, especially when investors are balancing different assets and timelines.

“Stocks are inherently volatile, at least in the short term,” Aaron Anderson, senior vice president of research at Fisher Investments, said. “They become much less so over the long term — meaning the further out you go, the longer your time horizon, the more consistent stock returns become.”

This type of coordination can help keep taxable events predictable, whether someone is drawing down tax-deferred savings, using Roth accounts later for flexibility, or handling unexpected income changes.

They Take Planning Seriously

Even with planning tools available, many Americans are unsure how far their savings will stretch. A Pew Research Center survey found that roughly four in 10 Americans don’t feel confident they will have enough money to last their entire retirement. That uncertainty stands in contrast to the longer-range planning affluent households do. Though an early start lets you take advantage of compound interest, planning at any stage makes retirement feel more attainable. The gap between where wealth is concentrated and how people feel about their own retirement shows how much planning shapes the experience.

They Know When to Ask an Expert

Few households sit anywhere near the top 0.1% in wealth, a group whose share of national assets matches that of the bottom 50%, but the way those investors plan their taxes and sequence their withdrawals can still serve as a playbook for the other 99.9% of retirees. Many affluent households trust professional advisors who help them take a longer-term view of taxes and make decisions spanning decades. Fisher Investments offers these same resources to everyday investors, explaining these concepts (and others) in more depth.

Read Fisher Investments’ Tax-Efficient Wealth Management for Affluent Investors guide to get additional insights into tax-smart planning.

Feature Image Credit: Jordan Siemens / Getty Images