Buying or selling a car can be complicated, confusing, and time-consuming. Fortunately, there are a few ways to make the process easier. One vital piece of information is the “Blue Book value” of your car. This value, derived from the Kelley Blue Book, a leading automotive guide, is a trusted benchmark that can help you negotiate a fair price and even score a deal. But what exactly is the Blue Book, and why do car dealers, buyers, and even insurance companies consider it the holy grail of car pricing? Let’s unveil the history and uses of this popular guide.

Who Is ‘Kelley’?

This historic automobile guide was named after Los Angeles car dealer Les Kelley. Cars weren’t just a career for Kelley but a way of life. He opened his first used car business, Kelley Kar Company, in 1918 with just three Model Ts for sale. Around the same time, he debuted his marketing campaign “Selected Blue Seal Automobiles,” which became the earliest version of the Kelley Blue Book seal. His sales soared during the early 1920s, and in 1926, Kelley published his first Blue Book, which included a list of cars he wanted to buy and what he was willing to pay for them.

The Rise of the Blue Book

Now North America’s most trusted vehicle price guide, Kelley Blue Book’s popularity took off during the 1930s, becoming the bestselling automotive book. By World War II, the U.S. government was using the Blue Book to set price ceilings for used cars. The 1960s and ‘70s brought big changes to the guide. It became the first guide to use mileage to determine a car’s value, and the company added a “New Car Price” list to its repertoire. This is also when the company’s first guides for other types of vehicles — motorcycles, travel trailers and campers, ATVs, snowmobiles, and manufactured housing — debuted.

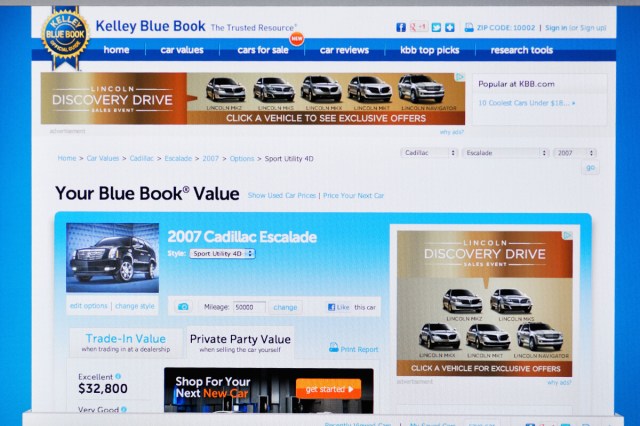

The Blue Book’s website launched in 1995, and within two years, it became the most visited automotive site on the internet. Today, it is an undisputed powerhouse among new and used vehicle pricing guides, providing thorough and up-to-date data to millions of consumers in the United States. The company also has automobile guides in Canada, Brazil, Australia, and China.

How to Use the Blue Book

The Blue Book is free to use. Simply enter the details of your vehicle or the vehicle you’d like to purchase on Kelley Blue Book’s website, and you’ll get instant feedback. The suggested prices are based on your entries, including the car’s make, model, style, year, mileage, and condition (fair, good, very good, or excellent). The Blue Book gives consumers a thorough snapshot of what a car is worth, but the information can be a little overwhelming for some.

When assessing a car on Kelley Blue Book, you’ll notice two different values: Fair Purchase Price and Fair Market Range. The Fair Purchase Price reflects the price most consumers pay for this vehicle. It is a regional price average adjusted weekly for current market conditions. This valuation is different from most other pricing guides, which often give the lowest price a car is selling for.

The guide also provides a Fair Market Range (with two numbers, one low and one high), which provides a broader perspective, estimating what consumers will pay this week in their area for the given vehicle based on year, make, model, and style. The range has nothing to do with the equipment or extras on the car (you already selected those during your input for the search). The range is solely based on recent transactions, supply, demand, and market changes.

Reader Favorites

More Blue Book Benefits

Not only does Blue Book give the Fair Market Range and the Fair Purchase Price, but consumers can also search for trade-in value, certified pre-owned value, and actual cash value. The latter comes in handy when filing a claim with your insurance company because you can check the Blue Book’s actual cash value against your insurance’s car valuation, leaving a possibility for negotiating if your valuation seems too low.

Users can also find helpful consumer ratings, video reviews, and 360-degree tours of vehicles for sale near you, making virtual car shopping more accessible than ever before. Once you’ve decided on a car, the online guide can also help you evaluate future costs, such as everyday maintenance, insurance, repairs, fuel, and anticipated depreciation.

More From Our Network

Better Report is part of Inbox Studio, an email-first media company. *Indicates a third-party property.